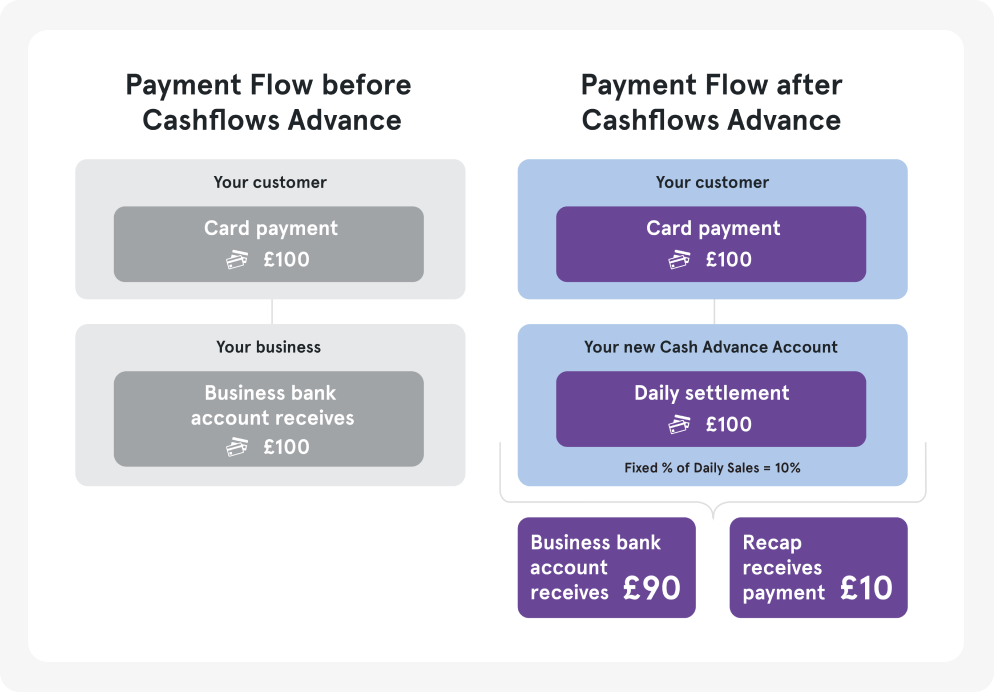

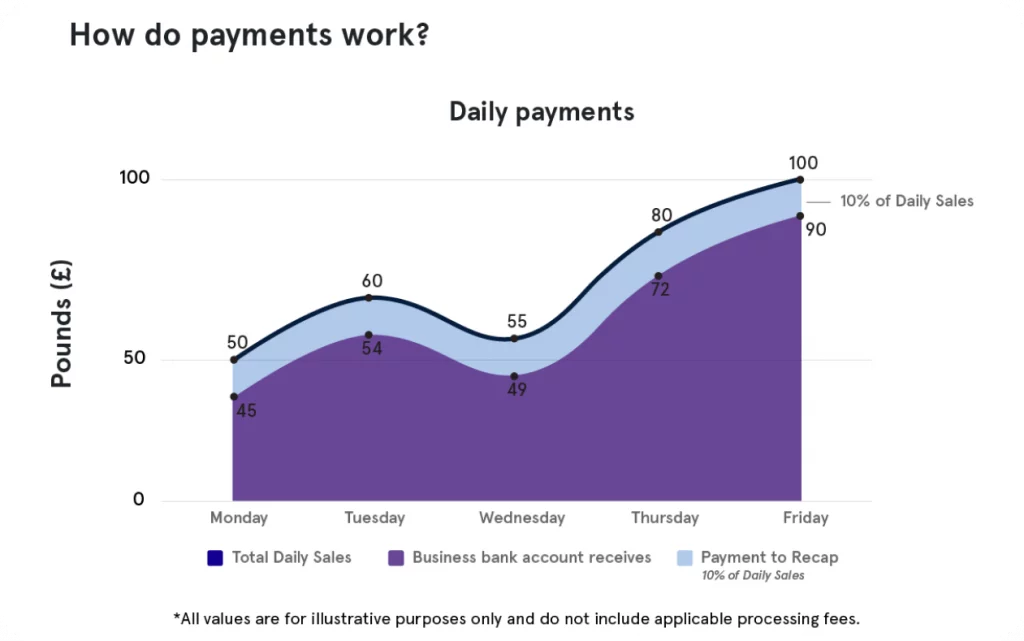

Cashflows Advance is our new funding solution, provided by our partner, Recap. Together, we provide Cashflows merchants a convenient and flexible way to get quick access to capital, through the Cashflows platform.

It’s the fastest way to get funding. Cashflows merchants are pre-qualified through anonymous transaction data with 6 months trading. Recap conducts the KYC and KYB to approve the application, and a percentage of future sales is used to repay.